Atlantic Nickel announces another record financial and operational performance in 2022

PR Newswire

01 Feb 2023, 14:30 GMT+10

|

LONDON, Feb. 1, 2023 /PRNewswire/ -- Atlantic Nickel ("Atlantic Nickel" or the "Company") and Appian Capital Advisory LLP ("Appian") are pleased to announce another record year of operational and financial performance at the Company's Santa Rita nickel sulphide mine ("Santa Rita" or the "Mine") located in Bahia, Brazil.

Santa Rita is one of the very few long-life nickel sulphide mines in operation globally, boasting 34 years of mine life producing between 20-35 ktpa NiEq contained in concentrate. Based on an NI 43-101 technical report completed in 2021, the operation mines an open-pit with a minimum 8-year life and an NPV8 of US$570m, and transitions to an underground sublevel caving operation for another 27 years with an NPV8 of US$812m. Capital expenditure for the underground is expected to be fully funded out of operating cash flow.

Separately, Appian owns Mineracao Vale Verde ("MVV") and its Serrote copper-gold mine in Alagoas, Brazil ("Serrote"), which completed construction ahead of schedule and under budget and achieved first production in 2021. In 2022, its first full-year of ramp-up, MVV achieved 105% nameplate capacity with no additional capital expenditure and generated US$60m in EBITDA. A fuller MVV operational update will be covered in a separate release.

Atlantic Nickel 2022 performance highlights

- Industry leading ESG and safety performance with a Lost Time Injury Frequency Rate of 0.18 over the last 12 months (compared to 0.20 in 2021)

- Strong financial growth with US$210m of EBITDA (2021 US$127m) on US$406m of revenue (2021 US$289m)

- Production of 117kdmt of nickel concentrate (2021 107kdmt) containing 15.9kt of nickel (2021 14.5kt), 5.0kt of copper (2021 4.7kt) and 291t of cobalt (2021 266t) in addition to gold, platinum and palladium by-products

- C1 cost of US$4.22/lb Ni maintains the Company's position as a consistent first quartile producer

- Hedging program secures forward pricing of >US$13.00/lb on a significant share of payable nickel produced through the end of 2023

Paulo Castellari, CEO of Appian Capital Brazil commented:

"2022 was a fantastic year for Atlantic Nickel. The quality of the asset and the expertise of our team has delivered excellent financial and operational results.

Importantly, we continue to lead the industry on safety and environmental standards, with a particular emphasis on providing the best-in-class safety culture and awareness at Santa Rita. As one of the leading nickel sulphide mines globally, with a C1 cost position maintaining the Company's position as a consistent first quartile producer, we are able to continue to deliver significant returns for our investors.

We look forward to continuing the development of the underground expansion at Santa Rita, as we capitalise on the site's full potential."

Safety

Santa Rita continues to operate as one of the safest operations globally with a Lost Time Injury Frequency Rate ("LTIFR") of 0.18 achieved over the last 12 months, an improvement on the strong LTIFR performance of 0.20 in 2021[1]. The Company's Visible Felt Leadership program resulted in over ~4,400 incident prevention safety measures, helping to convey safety as a top priority of Atlantic Nickel's management. Over 170,000 man-hours of safety, health and environmental training were conducted in 2022 which have contributed to the best-in-class safety culture and awareness on site at Santa Rita.

Operational update

Significant improvements in performance were delivered in 2022, including:

- 6.6Mt of ore mined from the open pit alongside 30.6Mt of waste, reflecting record mining rates and excellent progress on stripping

- 6.6Mt of ore fed to the mill, reflecting the highest annual throughput achieved since operations at Santa Rita first began back in 2009

- Ore fed to the mill at average feed grades of 0.30% NiS and 0.10% Cu

- 80.8% NiS recoveries were achieved at the plant

- 117kdmt of concentrate produced at average concentrate grades of 13.6% Ni and 4.2% Cu with cobalt, gold, palladium and platinum by-products

The first quartile C1 cost performance of US$4.22/lb Ni, net of by-product credits is driven by:

- Mining costs of US$3.36/t mined

- Processing costs of US$6.14/t processed

- Site general and administrative costs of US$1.46/t processed

- Downstream charges and transportation costs of US$1.77/lb payable Ni

- By-product credits of US$1.49/lb payable Ni

All-in sustaining cost performance of US$8.41/lb Ni, net of by-product credits is also driven by:

- Corporate general and administrative costs of US$1.13/t processed

- Royalties of US$0.64/lb payable Ni

- Sustaining capital expenditure of US$3.29/lb payable Ni, reflecting excellent progress on dam construction and capitalized stripping

Financial update

Over 2022, 12 shipments of concentrate were made to the Company's offtake partners resulting in revenue of US$406m with average realized commodity prices of US$12.23/lb Ni and US$3.70/lb Cu. EBITDA and capital expenditure for the period was US$210m and US$100m, respectively. This builds on the record financial performance in 2021, when Atlantic Nickel posted US$127m of EBITDA on US$289m of revenue.

In response to the highs witnessed in the nickel and copper markets in March of 2022, Atlantic Nickel initiated an opportunistic hedging program. The following non-deliverable forward contracts were entered into to sell throughout 2022:

- 5.7kt, or 12.6mlb, of nickel at an average forward price of US$13.17/lb

- 1.8kt, or 4.0mlb, of copper at an average forward price of US$4.52/lb Cu

Realized gains from these contracts, which amounts to US$35m, are excluded from the US$210m of EBITDA achieved in 2022.

Further, as of the date of this press release, the following contracts have been entered into to sell throughout 2023:

- 6.8kt, or 15.2mlb, of nickel at an average forward price of US$13.07/lb

- 1.2kt, or 2.6mlb, of copper at an average forward price of US$4.35/lb

Progress on the underground expansion

The Company remains firmly committed to advancing the underground project. Over US$17m was invested in 2022 towards the execution a 35,000m drill program and progressing studies which will be required to declare a reserve.

An underground variability sampling campaign has been conducted in 2022. 45 samples were prepared consisting of 40 variability samples and 5 composites, with each composite representing a different 5-year period in the underground mine plan. Locked cycle test on the 5 composites resulted in NiS recoveries ranging from 84.8% - 90.6%, supporting the prospect of even higher plant recoveries when processing feed with higher NiS grade from the underground operation.

Atlantic Nickel is continuing the development of the underground expansion in 2023 and aims to deliver a Prefeasibility Study by the end of the year.

Lastly, the Company continues to advance its regional exploration with its primary focus being the drill out and declaration of a resource at Palestina, the most advanced open pit exploration target. Palestina sits approximately 25 km from Santa Rita with easy access to Santa Rita's existing processing infrastructure.

About Appian

Appian Capital Advisory LLP is the investment advisor to long-term value focused private equity funds that invest solely in mining and mining related companies.

Appian is a leading investment advisor in the metals and mining industry, with global experience across South America, North America, Australia and Africa and a successful track record of supporting companies to achieve their development targets, with a global operating portfolio overseeing nearly 5,500 employees.

Appian has a global team of 58 experienced professionals with offices in London, Toronto, Lima, Belo Horizonte, Montreal and Sydney.

For more information, please visit www.appiancapitaladvisory.com, or find us on LinkedIn or Instagram

About Atlantic Nickel

Atlantic Nickel is the owner and operator of Santa Rita, an open-pit nickel-copper-cobalt sulphide operation located in Bahia, Brazil. Santa Rita is an operating open pit mine that is planning to transition to underground mining to extend its mine life to 34 years. The mine benefits from US$1bn of prior investment and has a plant capacity of 6.5 Mtpa. One of the largest open pit nickel sulphide mines in the world, Santa Rita is a high-quality asset operating at a first quartile cost position. It is one of a few remaining nickel sulphide mines globally that can offer additional supply towards the production of Class I nickel products and so has exposure to the high-growth potential of the electric vehicle industry.

[1] The industry average LTIFR was 1.53 in 2020, as reported by Global Data

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Vietnam Tribune news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Vietnam Tribune.

More InformationSoutheast Asia

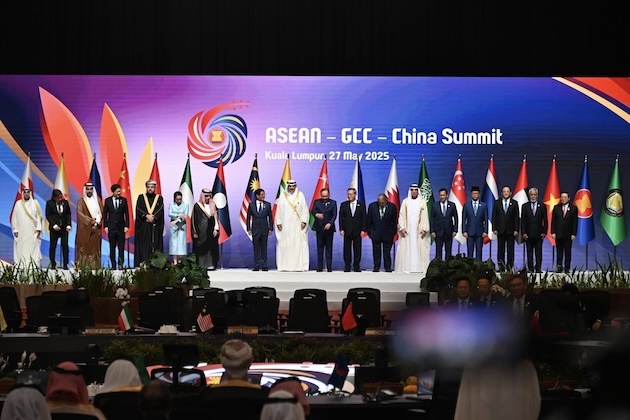

SectionASEAN Reaffirms Commitment to Myanmar Peace Process, Urges Ceasefire Extension

KUALA LUMPUR, Malaysia - At a meeting on Tuesday in the Malaysian capital, Kuala Lumpur, ASEAN leaders reiterated their commitment...

Trump-backed $1.5 billion golf project breaks ground near Hanoi

HUNG YEN, Vietnam: A new US$1.5 billion luxury golf and residential project backed by the Trump Organization officially broke ground...

INDONESIA-JAKARTA-FRANCE-EMMANUEL MACRON-VISIT

(250528) -- JAKARTA, May 28, 2025 (Xinhua) -- French President Emmanuel Macron (L) shakes hands with Indonesian President Prabowo Subianto...

"Maintains proximity with Pakistan....": Assam CM Sarma levels fresh allegations against Congress' Gaurav Gogoi

New Delhi [India], May 28 (ANI): Assam Chief Minister Himanta Biswa Sarma on Wednesday levelled fresh serious allegations against Congress...

India's all-party delegation meets Indonesia's Vice Minister of Foreign Affairs

Jakarta [Indonesia], May 28 (ANI): The all-party parliamentary delegation, led by JD(U) MP Sanjay Kumar Jha, held a meeting with Indonesia's...

Pakistani forces accused of killing two, injuring one in late-night Balochistan raid; BWF calls strike in Awaran

Balochistan [Pakistan], May 28 (ANI): Pakistani military forces are said to have killed two people, including a woman, and severely...

International

SectionHistoric vote for judges in Mexico marred by criminal ties

CIUDAD JUAREZ, Mexico: In a first-of-its-kind judicial election in Mexico, more than 5,000 candidates are vying for over 840 federal...

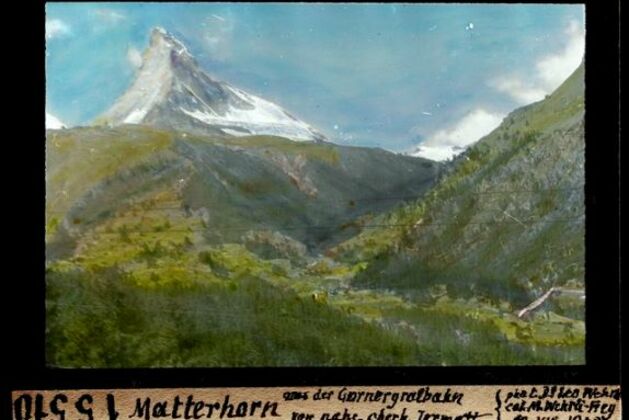

Bodies of 5 missing skiers recovered on mountain in Switzerland

ZERMATT, Switzerland: Five skiers were found dead on a mountain in Switzerland near the popular ski resort of Zermatt, officials said...

Canadians turn out in thousands to pay tribute to Israel

TORONTO, Canada - Tens of thousands of people from across Canada have marched in support of Israel in a massive turnout in Toronto....

Foreign students at Harvard bear the brunt of White House ban

BOSTON, Massachusetts: U.S. President Donald Trump's administration has taken away Harvard University's right to enroll international...

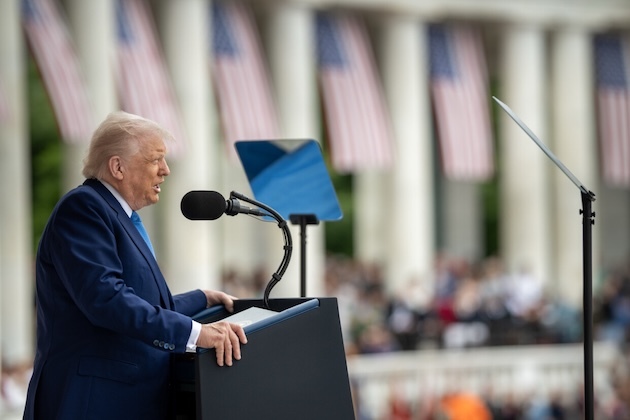

God responsible for his presidency, claims Trump

WASHINGTON, DC - U.S. President Donald Trump on Monday said he believed God was behind his election loss in 2020, even though he has...

Passenger traffic plummets at Newark Airport amid travel disruptions

NEW YORK CITY, New York: Passenger numbers at Newark Liberty International Airport in New Jersey have dropped sharply, according to...